Legal & General Capital has a track record of successful investment partnerships and of delivering economically and socially important schemes across the country.

LGIM Real Assets

LGIM Real Assets is a division of Legal & General Investment Management (LGIM), one of Europe’s largest institutional asset managers and a major global investor.

Ancora

A 50:50 partnership with US based real estate developer, creating a real estate platform dedicated to driving science and technology growth across the US.

Oxford University Development

In 2019 we established Oxford University Development (OUD) a joint venture partnership with Oxford University, to design and deliver exemplary, sustainable development that meets the future needs of Oxford University, contributes to the wider economy of Oxfordshire and creates economic and social benefits for local communities.

UCL Institute of Health Equity

To tackle the injustice of health inequity across the UK, we have partnered with the Professor Sir Michael Marmot and the UCL Institute of Health Equity to examine how improvements to the design and construction of our towns and cities can help to address health inequalities and support “levelling up” across the UK’s regions.

Bruntwood

In 2018, we founded Bruntwood Scitech, which is we scaled into the UK’s leading developer of city-wide innovation ecosystems and specialist environments, helping companies - particularly those in the science and technology sectors - to form, scale and grow.

Pod Point

Pod Point is one of the UK’s leading companies in providing electric vehicle charging solutions for homes, the workplace and commercial organisations, with a focus on delivering strong customer satisfaction.

EDF

EDF is leading the transition to a cleaner, low emission electric future, tackling climate change and helping Britain reach net zero.

Goldacre

Goldacre is an innovative family office investment house. As part of the Noé Group we leverage the scale of a £2bn asset management business with the nimbleness of a boutique.

Scarborough Group

Legal & General Capital entered into a joint venture partnership with specialist real estate investor and developer, Scarborough Group International, in August 2015 when it acquired a 50% stake in Thorpe Park, a 200 acre development site in East Leeds.

Pemberton

In 2014, we acquired a 40% equity stake to scale Pemberton’s private credit asset management platform and to accelerate the deployment of capital lending to mid-market businesses across Europe.

PGGM

Legal & General Capital and Dutch pension fund manager, PGGM, have established three strategic joint venture partnerships to date.

Muse

Muse Developments is working in partnership with Legal & General Capital and the Homes & Communities Agency to bring forward the English Cities Fund′s portfolio of major regeneration schemes in Salford, Liverpool, Wakefield, Canning Town and Plymouth.

Homes England

The Homes & Communities Agency is working in partnership with Legal & General Capital and Muse Developments to bring forward the English Cities Fund′s portfolio of major regeneration schemes in Salford, Liverpool, Wakefield, Canning Town and Plymouth.

Rightacres Property

Legal & General Capital entered into a partnership with Cardiff-based developer, Rightacres, in September 2015 to bring forward Central Square in Cardiff, a prime 12 acre, mixed-use regeneration scheme in the heart of the city centre.

NTR

NTR plc is a renewable energy investment management group that acquires, constructs and manages assets directly and for third parties.

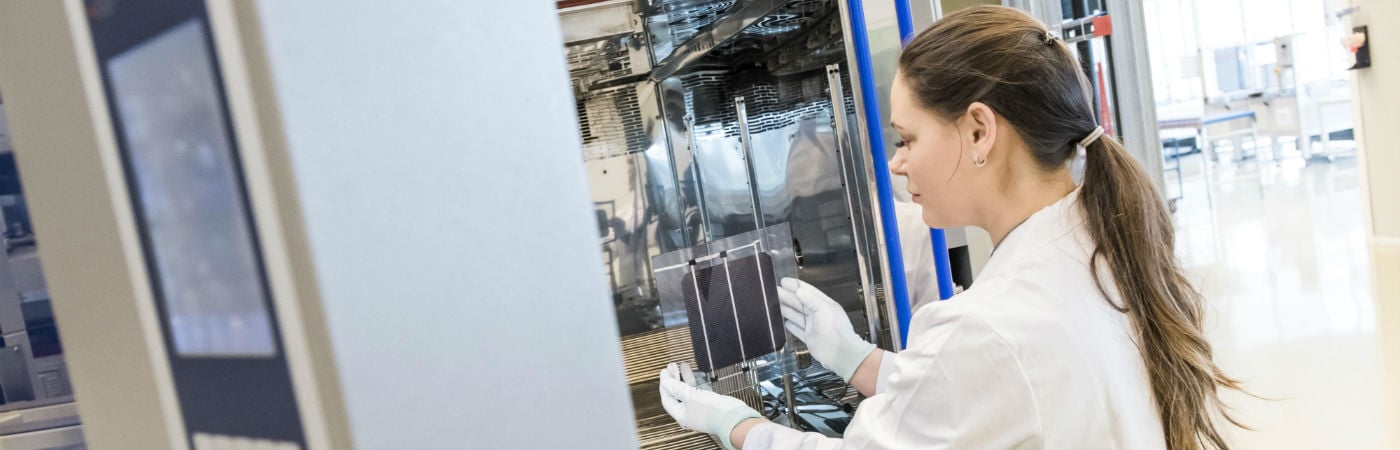

Oxford PV

In November 2016, LGC invested £2.5m in Oxford Photovoltaics Limited (Oxford PV), a spin-out from the University of Oxford, to commercialise perovskite, a low-cost, highly efficient solar cell absorber material that can vastly improve a solar panel’s ability to convert sunlight into electricity.

Public Practice

Public Practice is a value-led organisation that delivers services to support the public sector develop its placemaking leadership capabilities. Local and Combined Authorities are crucial to shaping their places to reduce inequality and improve lives. To achieve this, they must be well-resourced with diverse placemaking skills and proper support. We are working with Public Practice to address these needs.

ImpactA

In March 2023, we invested into ImpactA Global, a new women-led Impact asset management firm, to support in building its business deploying capital which finances sustainable emerging market infrastructure projects.

ImpactA Global is seeking to catalyse investment in climate transition and sustainable infrastructure, bridging funding gaps to unlock critical investment that will aid the climate transition and help address inequalities across Emerging Markets.

Octopus Energy Generation

In 2023 we partnered with Octopus Energy Generation to invest £70m to scale ground source heat pump business The Kensa Group - Britain’s biggest investment in ground source heat pumps to date.

Octopus Energy Generation is one of Europe's largest investors in renewables and energy transition technologies. It is the green generation arm of Octopus Energy, a global energy and technology group, driving the affordable, green energy system of the future.