Legal & General, Bruntwood And Greater Manchester Pension Fund Invest Half A Billion Into The UK’s Science, Tech & Innovation Economy

- Local government pension funds to support high-growth innovation sectors and regeneration of towns and cities

- Investments deliver specialist infrastructure and support, and world-leading lab and office space for businesses across the country

- Patient capital is crucial to UK’s goal to become a science and tech superpower by 2030

Bruntwood SciTech, the UK’s leading specialist property provider, founded by Legal & General and Bruntwood in 2018 to support the growth of the life science and tech sectors, has secured £500 million of additional investment and welcomed the UK’s largest local authority pension fund, Greater Manchester Pension Fund (GMPF), to the partnership.

GMPF is the first local government pension scheme to make a direct and active investment into a UK-wide science, tech and innovation specialist property platform. The deal demonstrates the role that such funds can play in regenerating the UK’s towns and cities; helping to create highly-skilled jobs, increase productivity and drive wage growth, while supporting the UK’s target to become a global science and technology superpower by 2030.

Now the largest dedicated property platform serving the UK’s innovation economy, Bruntwood SciTech aims to create a £5 billion UK-wide portfolio that can support 2,600 high-growth businesses by 2032. The £500 million of new equity sees GMPF inject £150 million, alongside a significant increase in investment from existing shareholders, Legal & General and Bruntwood, through cash and asset transfer.

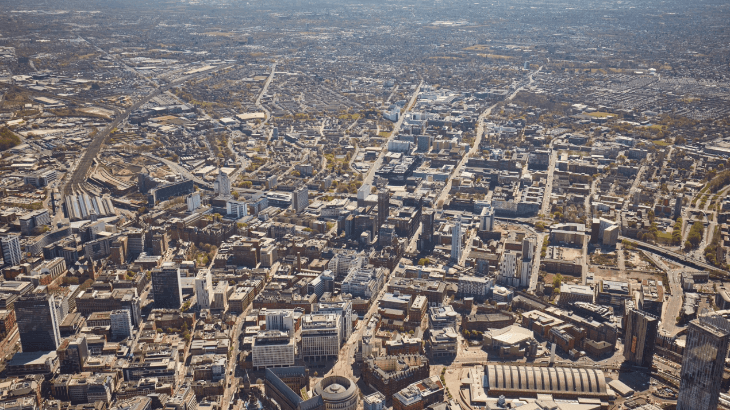

The new capital will be used to expand and redevelop existing science and technology campuses and city centre innovation hubs, delivering much-needed additional world-leading lab and office space in Manchester, Birmingham, Leeds, Liverpool, Glasgow and Cambridge, across a secured 3.6m sq ft development pipeline. The investment will also enable Bruntwood SciTech to enter additional R&D intensive regional cities.

Critically, Bruntwood SciTech provides the connective tissue between world-leading research universities, large hospital NHS Trusts, strong civic regional leadership, and high-growth enterprise. Already, it has more than £1.5bn in assets across nine campus locations and 31 city centre innovation hubs, offering 4.8m sq ft of world-class specialist workspace, support, and like-minded communities for 1,100 high-growth start-ups, scale ups, and global businesses.

Over the last five years, Bruntwood SciTech, which began with a portfolio of 1.3m sq ft, has proven its ability to create places that nurture and grow innovation-based businesses, especially those working within the life science and tech sectors. Several developments are already underway that will support the growth of city-wide like-minded ecosystems for A.I, medtech, diagnostics, genomics, fintech, edtech and digital health businesses. This includes Citylabs 4.0 in Manchester - a health innovation and precision medicine hub, Birmingham’s first truly smart building Enterprise Wharf, and a new dedicated digital and tech hub at Glasgow’s Met Tower.

With the UK still behind some of its global competitors in providing the necessary volume of specialist infrastructure for the science and technology sector to scale[1], offer more highly-skilled jobs, and contribute an even greater economic return, Bruntwood SciTech has a clear focus on providing the UK’s regional cities with the capacity they need to support future growth.

Through its new structure, Bruntwood SciTech has enabled other UK local authority pension funds to co-invest efficiently and on an asset by asset basis, so that long term, patient capital can play a crucial role in the growth of the domestic innovation sector. Discussions are already underway with a number of other major local authority-linked funds for additional capital investment.

“Legal & General Capital has long been committed to investing in an innovation backbone for the UK, providing the infrastructure that businesses, universities, and the public sector need to thrive. This partnership with Greater Manchester Pension Fund is testament to the strength of the platforms we have created and the track record of our investments. It is particularly special to Legal & General given our long history of investment in and around Manchester.

Bruntwood SciTech is a unique opportunity to invest in, and develop, a significant, patient capital project that is economically viable and socially useful. By bringing Greater Manchester Pension Fund alongside us, we can further scale our impact and deliver on a shared purpose to use society’s capital for society’s benefit. Together with GMPF, we’re bringing a fresh injection of capital which reinforces our commitment to and underlines our belief in the UK’s long-term role as a global tech powerhouse and scientific superpower.”

Laura Mason, CEO of Legal & General Capital

“In GMPF we have found a partner who shares mutual strategic vision, values, cultural alignment and passion for the key sectors of the UK economy which have the biggest potential for growth. Bruntwood, Legal & General and GMPF are each committed to creating thriving cities, are deeply rooted in the places in which we invest, and are focussed on the application of long-term, patient capital to support the UK’s economy, with a particular focus on its regional cities.

GMPF’s investment, alongside the additional capital from Legal & General and assets from Bruntwood, will elevate the potential of Bruntwood SciTech even further, accelerate the delivery of our expansion pipeline, and maintain our market leading position as the workspace provider of choice for innovation-led businesses. We will also be able to further support the delivery of strategic city visions and innovation strategies in the UK’s fastest growing regional cities.”

Chris Oglesby, Executive Chair of Bruntwood SciTech and CEO of Bruntwood

“We have long admired Bruntwood SciTech and seen its impact on our doorstep in Manchester, not least in leveraging the strength of its universities to create innovation districts with a genuine global reputation that are capable of attracting companies like Roku and Qiagen to the city.

We’re investing from society for society by deploying our capital to benefit the UK’s regional economies for the long-term, helping develop the innovation infrastructure they need in order to scale in world-leading workspaces and supporting them to attract the best, and most highly skilled talent, enter new markets, and be supported in accessing new funds.

We’re excited about how we can now help to bring forward Bruntwood SciTech’s pipeline of transformational, world-class developments and for a future in which we spread its impact even more so in its existing cities, and into new ones.”

Cllr Gerald Cooney, Chair of the GMPF Pension Fund

“We’ve done some amazing things over the last five years by partnering with city regions on their investment strategies and helping create the places they need to unlock them.

The investment from GMPF demonstrates the strong impact and proposition Bruntwood SciTech has developed, and we are excited to bring in a like-minded third-party investor to support the key priority sectors for the UK in our mission to expand the portfolio further.

The UK’s real estate market is in a challenging period, but this deal, which will stand out as one of the most significant transactions this year, is about three organisations aligned in both their visions and commitment to investing for the long-term. It underlines our absolute confidence in our business model and proposition’s success, and we can now realise it at scale across more locations.”

Kate Lawlor, CEO for Bruntwood SciTech

Since Bruntwood SciTech was created in 2018 it has grown Alderley Park into the UK’s largest single site life science campus and is home to major institutions including the Medicines Discovery Catapult. In Manchester it has accelerated progress with campuses developed at Circle Square, Citylabs, and Manchester Science Park where the latest development will become the new HQ for UK Biobank. It has also been appointed JV partner in the £1.7bn trailblazing new city centre innovation district ID Manchester by The University of Manchester.

It acquired and more than doubled its Innovation Birmingham campus - creating Birmingham’s first truly smart building and the West Midlands largest dedicated tech community. It is also underway with the first phase of the Birmingham Health Innovation Campus in collaboration with the University of Birmingham.

In the past 12 months in Cambridge it acquired and submitted a £250m masterplan for Melbourn Science Park and in Glasgow, adjacent to Strathclyde University, acquired its first property in Scotland to transform Glasgow’s iconic Met Tower into a new tech hub.

In Liverpool, it is a shareholder in Sciontec, the owners of Liverpool Science Park, working alongside Liverpool John Moores University, the University of Liverpool and Liverpool City Council, where it has plans to expand its holdings in Sciontec to develop new lab and office buildings in the City’s Knowledge Quarter (KQ Liverpool), whilst in Leeds it has created the city’s ‘home for tech’, Platform.

GMPF was selected following a competitive process for new equity funding partners that saw active discussions with UK and global institutional investors.

The acquisition of Bruntwood’s city centre assets by Bruntwood SciTech comes as a response to the changing needs of innovation-led businesses post-pandemic. This will enable specialist workspaces and communities to be created within both city centres and at campuses located next to universities and hospitals, recognising that businesses are looking to leverage ecosystems on a city-wide basis instead of within defined innovation districts.

Bruntwood will separately retain a £260m portfolio of workspaces, primarily located in suburban town centres, alongside a £100m portfolio of town centre regeneration projects with Trafford and Bury Councils. This part of the business will focus on creating locally distinctive, sustainable, culturally rich and socially responsible communities. It will aim to make further acquisitions in the towns surrounding the cities in which Bruntwood SciTech operates and work to develop a symbiotic relationship between the innovation economies of the cities and their surrounding towns.

Legal & General invests in asset classes that create long-term, secure income streams, to help meet its own annuity commitments, and for third party investors, whilst tackling some of the major social, environmental and economic issues society is facing. It now has extensive experience in investing in life science, technology and innovation, as strategic partner of choice to leading universities, including the University of Manchester, University of Oxford (through the Oxford University Development Partnership), the University of Cambridge and Newcastle University. It is also building partnerships in the US through Ancora L&G, which acquires and develops real estate to serve high-growth science, technology, and innovation tenants in partnership with and proximate to leading US anchor institutions.

Bruntwood and Legal & General were advised by Eastdil and GMPF by CBRE.

Legal and property advisors were Freshfields, Addleshaw Goddard, Eversheds, Mills & Reeve, JLL, Deloitte, Greenberg Traurig (GT Law), Grant Thornton and PWC

Download the full press release here

[1] “https://www.reuters.com/world/uk/lab-crunch-british-science-has-nowhere-go-2023-06-20/”